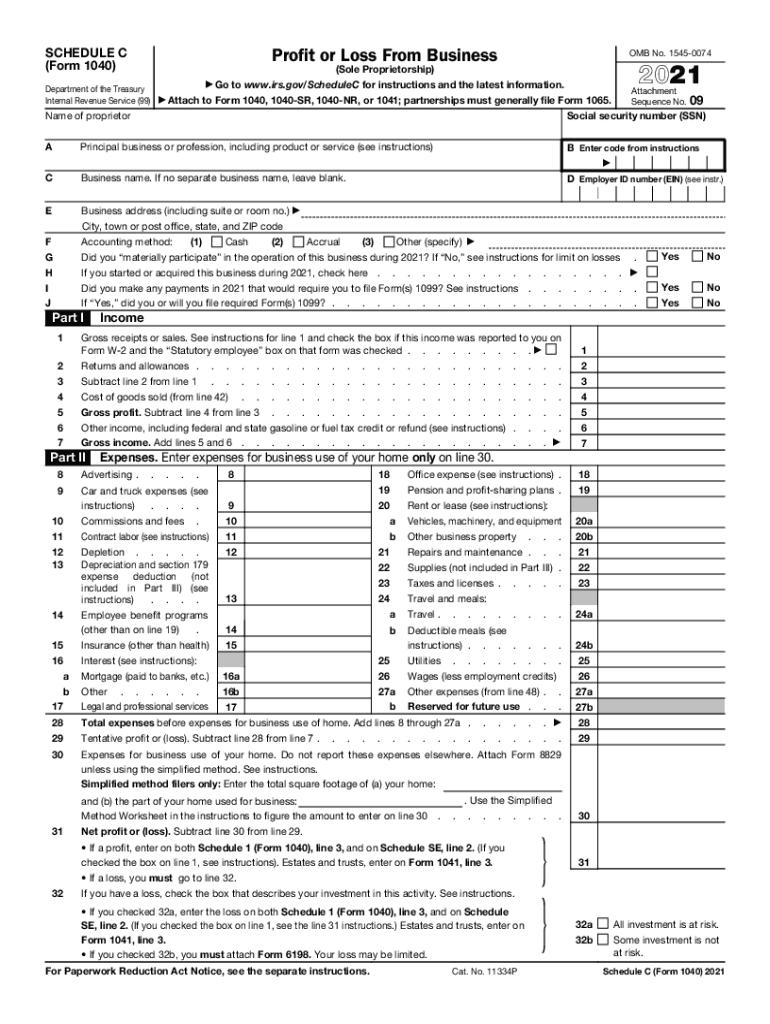

2024 Schedule C Form 1 – Form 1040, Schedule C, Line 1 Report all money you collected in your business on Line 1 of Schedule C. This amount should include all commercial sales taxes you collected. You do not need to . Schedule C calculates your net business income. Line 12 of Schedule 1, “Additional Income and Adjustments to Income,” is where you must report this amount. Your Form 1040 tax return is accompanied by .

2024 Schedule C Form 1

Source : irs-schedule-c-ez.pdffiller.comWhat Is Schedule C (IRS Form 1040) & Who Has to File? NerdWallet

Source : www.nerdwallet.com2023 Instructions for Schedule C

Source : www.irs.govBank loan obtained by the candidate committee

Source : www.fec.gov1040 schedule c: Fill out & sign online | DocHub

Andrew Lokenauth | TheFinanceNewsletter.on X: “Tax Season is

Source : twitter.comIRS 1040 Schedule C 2021 2024 Fill and Sign Printable Template

Source : www.uslegalforms.comEric Zhu on X: “This feels like the IRS is trying to Wile E

Source : twitter.comMA Schedule C 2022 2024 Fill and Sign Printable Template Online

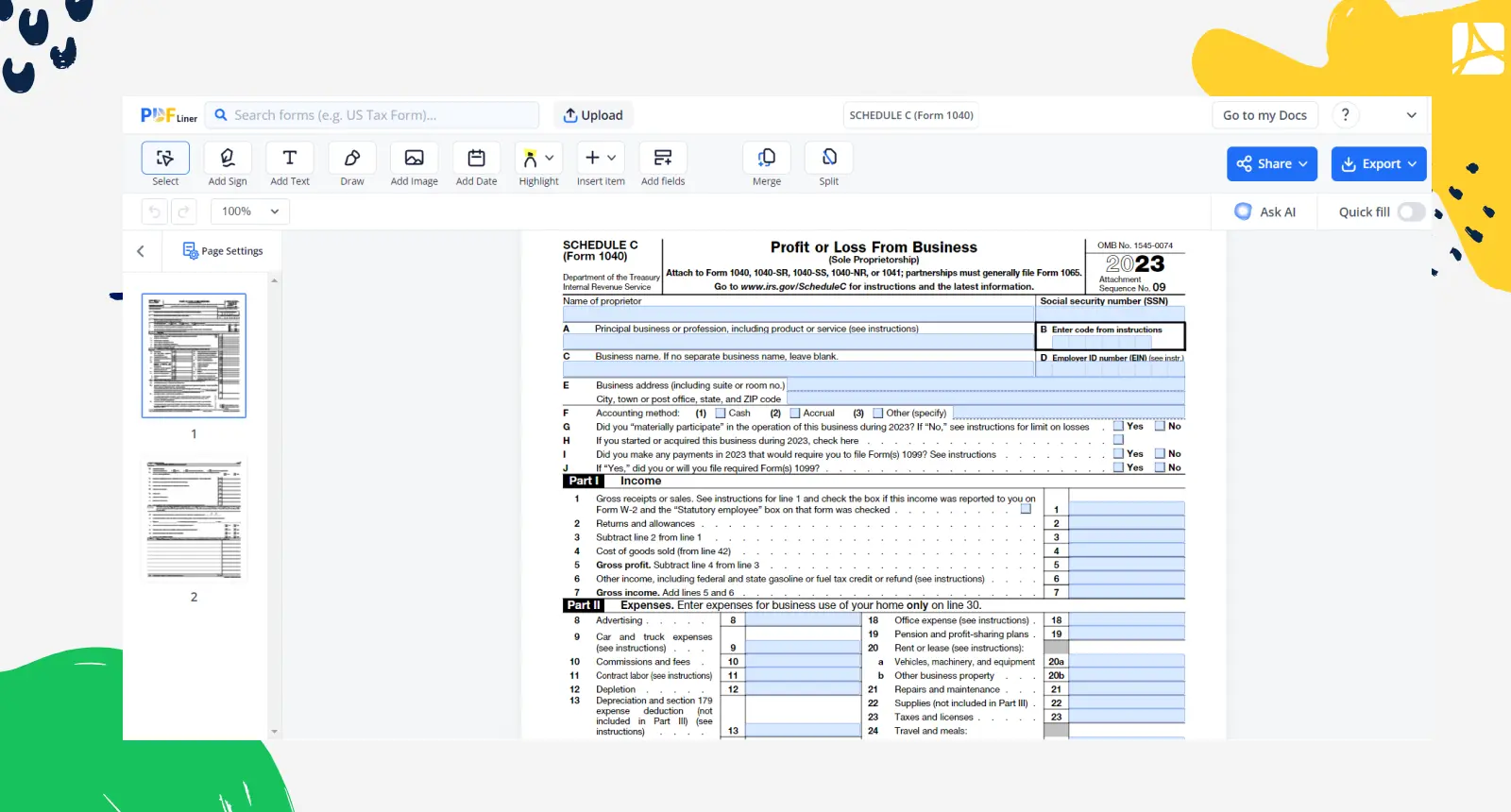

Source : www.uslegalforms.comTaxes Schedule C Form 1040 (2023 2024) | PDFliner

Source : pdfliner.com2024 Schedule C Form 1 2018 2024 Form IRS 1040 Schedule C EZ Fill Online, Printable : Are there ways to reduce this tax burden? Here’s what you need to know. Schedule C (1040) is an IRS tax form for reporting business-related income and expenses. Its official name is Profit or Loss . You take the deduction on Schedule C if you are self-employed or a sole proprietor, or as an itemized deduction on Form 1040 if you are effective from October 1 through September 30 of the .

]]>